Key results in 2021

Major business results

Summary of business results (continuing operations)

In 2021, the consolidated net profit from continuing operations totalled EUR 4.13 million (2020: EUR 2.57 million), which is EUR 1.57 million and 61% better as compared to 2020. The net profit for 2021 was impacted by one-off finance income for fair value adjustment of the outstanding commitment related the purchase price of the ticket sales platform in the amount of EUR 0.4 million (2020: EUR 0.7 million).

The Management Board proposes to pay dividends from the net profit for the 2021 financial year to the shareholders in the amount of 5 euro cents per share, in the total amount of EUR 1.51 million, resulting in a dividend rate of 37% (calculated on the net profit from continuing operations) and dividend yield of 3.2%. The Supervisory Board of AS Ekspress Grupp has approved the group's dividends policy, according to which Ekspress Grupp will pay at least 30% of the annual profit as dividends starting from 2022.

Summary of business results (continuing operations)

1. Digitalisation is one of the most important and fastest-growing megatrends. It is a major challenge to all group companies in terms of technological capacity, staff competence as well as meeting reader and customer expectations. Media publications must constantly offer readers newer and more exciting solutions and formats for presenting journalistic content in smart devices, investments in technology must ensure uninterrupted availability of products/services and employees are challenged by growing need for competence.

2. Polarisation in the society. In the last couple of years, the polarisation of the society has become clearer than ever before. Debates take place on very rigid positions and people are under growing pressure to take a side in terms of their worldview. This trend has been shaped by politics (liberals vs. conservatives), the COVID pandemic (vaccinated vs not vaccinated) and social issues (e.g. same-sex marriage, prohibition of abortion, etc.) in the home markets of the group companies as well as in the region, in the neighbouring countries and globally. In 2021, these trends had real consequences for media houses as more people cancelled their digital subscriptions because they did not agree with the views and opinions published by the media outlet. This is also a challenge for the media in making sure that the content is balanced and that everybody has an opportunity to present their side of the story.

3. Paid digital media content. The whole digital media is moving towards paid content. Paid digital subscriptions have become the new normal and people are increasingly willing to pay for quality journalism. Paid digital subscribers are highly valued and offered additional products and services that fit their profile.

In 2021, media segment revenue totalled EUR 52.1 million (2020: EUR 43.7 million). Revenue increased by 19% as compared to the last year. Revenue growth is attributable to active online advertising market which continues to growth as compared to traditional media outlets. In the 4th quarter, the Baltic online advertising market increased by more than 20% as compared to the same period last year. Paper media advertising has been struggling and we believe will not reach its previous pre-Covid levels going forward. All-in-all the advertising market has not grown in the Baltics. The digital channels have gained momentum at the expense of other advertising channels which we believe will be a continuing trend in the future.

At the end of 2021, the share of the Group's digital revenue made up 76% of total revenue (31.12.2020: 70%).

In 2021, the EBITDA totalled EUR 8.9 million (2020: EUR 6.6 million). As compared to the previous year, EBITDA increased by 35%. This was positively impacted by a strong sales of online advertising, digital subscriptions and tight cost controls carried out throughout the Group. In 2021, the EBITDA was also positively impacted by a one-off state subsidy in Latvia in the amount of EUR 0.41 million related to the ticket sales platform where events had been cancelled during the period of almost 7 months (2020: EUR 0.9 million in Estonia and Latvia).

The state of emergency related to COVID-19 has had the most profound impact on the Latvian ticket sales platform. In the 4th quarter of 2020, a state of emergency was imposed and all events were cancelled. The state of emergency in Latvia lasted until 4 April 2021 but strong restrictions remained in place until mid-June 2021. While most events took place in the 3rd quarter, starting from 11 October 2021 a state of emergency was reinstated in Latvia and from 21 October until 15 November 2021, all concerts were cancelled and theatres were closed in Latvia as additional restrictions. As from 15 November 2021, public events can be held, but there are still significant restrictions. In view of the spread of the Omicron variant and related developments in other countries, as well as the forecasts by epidemiologists, on 6 January 2022, Latvia took a decision to extend the state of emergency until 28 February 2022. It is expected that restrictions in Latvia will be relaxed from 1 March 2022 and events for up to 1,000 visitors are allowed indoors.

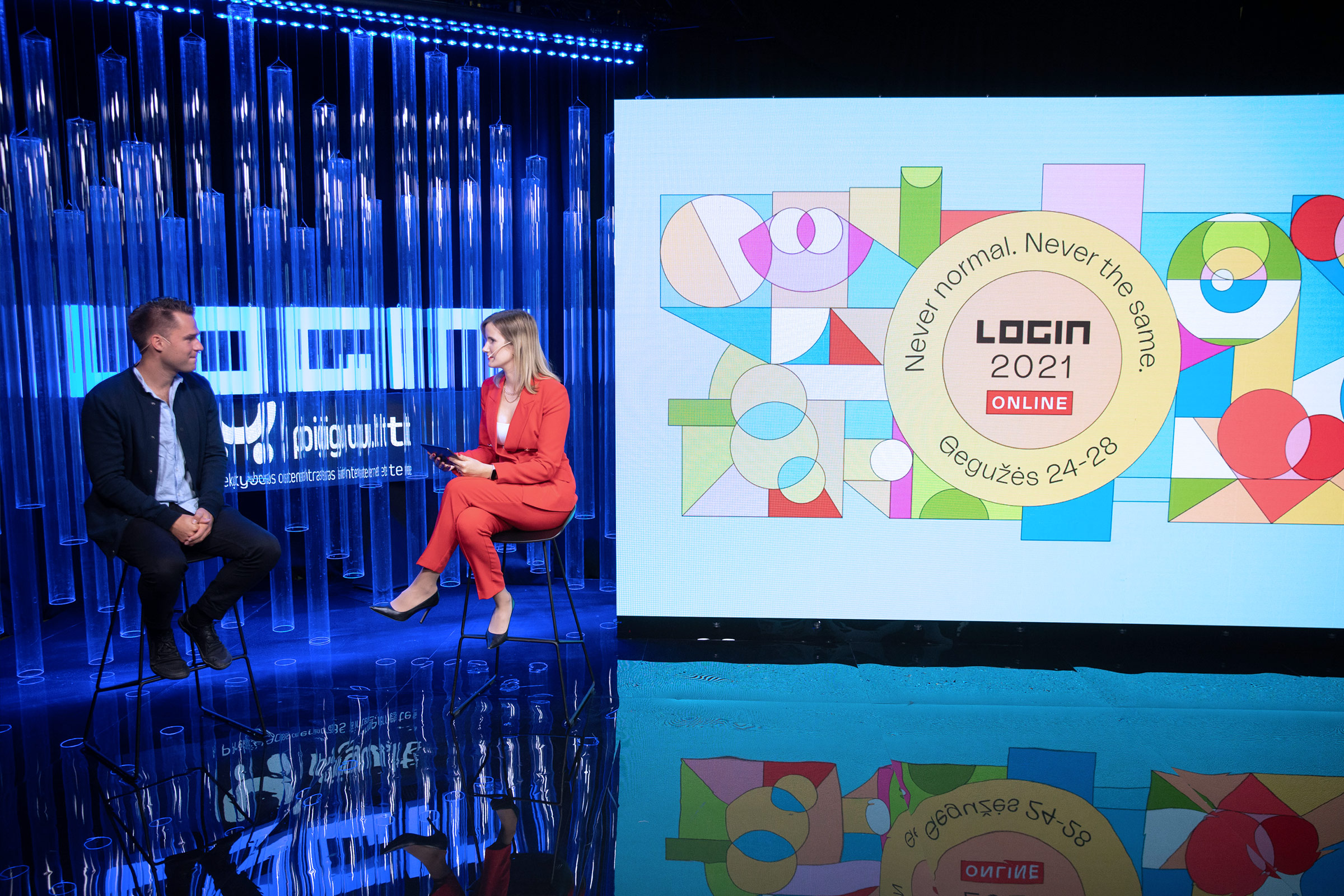

Starting from April 2021 the Group also entered the Estonian market with the ticket sales platform Piletitasku in Estonia. With the expansion of the ticket sales business into Estonia, the Group will continue its current strategy, the purpose of which is to increase the share of digital revenue and identify synergies between new business lines and existing media activities. We wish to provide the most convenient platform both for ticket buyers as well as event organisers. The platform has been well received during 2021 and group continues with its strategy by increasing the market share in 2022.

The Latvian outdoor media company SIA D Screens that won a public tender granting it the right to rent the real estate properties owned by the City of Riga in the first half of the year, will actively continue developing the outdoor screen network. The contract enables the company to expand its network to more than 100 screens and participate in the market with both large and small screen networks that cover the most important roads in Riga. New screens will be installed by end of 2022.

In December 2021, AS Ekspress Grupp acquired a 100% of shares in the media company Geenius Meedia OÜ. The purpose of the acquisition was to grow the digital media business and expand into a niche that the publications of Ekspress Grupp do not yet regularly cover. The shared goal of Ekspress Grupp and Geenius Meedia is to continue offering attractive content for the readers of geenius.ee. After the transaction, Geenius Meedia OÜ continues to operate as a separate media company. As a group, Ekspress Grupp offers Geenius Meedia synergy in functions supporting the media business, providing notably bigger growth potential for the fast-growing company. The results of Geenius Meedia OÜ will be included in the Group's consolidated reports from 2022.

The joint venture Õhtuleht Kirjastus AS, a key media company on the Estonian market is recognised under the equity method and included as one line item within finance income in the Group's results. In 2021, the revenue totalled EUR 13.9 million (2020: EUR 13.4 million).

- The number of digital subscriptions of AS Ekspress Meedia that publishes the news portal Delfi, newspapers Eesti Päevaleht, Maaleht, Eesti Ekspress and several popular magazines increased by 51% year-over-year and totalled 74 873.

- The number of digital subscriptions of AS Õhtuleht, 50% of which is owned by Ekspress Grupp, increased by 52% year-over-year and totalled 20 992.

- The number of digital subscriptions of Geenius Meedia OÜ, that has been part of Ekspress Grupp since 17 December 2021, more than doubled year-over-year and totalled 4 100.

- In Latvia, the number of digital subscriptions of Delfi A/S increased by 57% year-over-year and totalled 17 549.

- In Lithuania, the number of digital subscriptions of Delfi more than doubled year-over-year and totalled 17 433.

In 2021, digital subscription growth of the key periodicals and in the key markets of Ekspress Grupp continued. Additional digital growth is primarily attributable to new customers. Latvia and Lithuania where until now the number of digital subscribers was lower demonstrated the fastest growth. The Estonian market also continued its fast growth in a year-over-year comparison. However, in the last quarter growth decelerated in the outlets with the highest number of subscribers. Still, the Group is witnessing continuation of moderate growth also in Estonia.

The addition of digital subscriptions will have a positive impact on the results of operations of Ekspress Grupp as it provides a stable revenue base in addition to online advertising sales and confirms that the group’s long-term strategic direction is appropriate.

| Performance indicators (EUR thousand) | 2021 | 2020 | Change % | 2019 | 2018 | 2017 |

| Continuing operations | ||||||

| Sales revenue | 53,516 | 44,514 | 20% | 44,717 | 37,879 | 32,180 |

| EBITDA | 8,240 | 5,924 | 39% | 4,904 | 2,041 | 2,528 |

| EBITDA margin (%) | 15.4% | 13.3% | 11.0% | 5.4% | 7.9% | |

| Operating profit /(loss) | 4,864 | 3,071 | 58% | 2,337 | 850 | 1,766 |

| Operating margin (%) | 9.1% | 6.9% | 5.1% | 2.0% | 4.9% | |

| Interest expenses | (709) | (860) | 18% | (1,085) | (721) | (653) |

| Profit (loss) of joint ventures under equity method | (281) | 102 | -376% | (38) | (273) | (2) |

| Net profit from continuing operations | 4,133 | 2,566 | 61% | 755 | (614) | 991 |

| Net margin (%) - continuing operations | 7.7% | 5.8% | 1.7% | -1.6% | 3.1% | |

| Return on assets ROA (%) | 2.4% | 2.7% | 1.6% | 0.0% | 4.2% | |

| Return on equity ROE (%) | 4.1% | 4.9% | 2.8% | 0.0% | 6.1% | |

| Earnings per share (euro) - continuing operations | ||||||

| Basic earnings per share | 0.14 | 0.09 | 0.03 | (0.02) | 0.03 | |

| Diluted earnings per share | 0.13 | 0.08 | 0.03 | (0.02) | 0.03 | |

| * For years 2020-2017 the return on capital employed (ROCE) (%) ratio is calculated on the basis of EBIT, which also includes EBIT from discontinued operations. | ||||||

| Balance sheet (EUR thousand) | 31.12.2021 | 31.12.2020 | Change % | 31.12.2019 | 31.12.2018 | 31.12.2017 |

| As of the end of the period | ||||||

| Current assets | 20,553 | 18,482 | 11% | 19,472 | 13,831 | 13,827 |

| Non-current assets | 73,705 | 75,695 | -3% | 75,935 | 62,907 | 62,130 |

| Total assets | 94,258 | 94,177 | 0% | 95,407 | 76,738 | 75,957 |

| incl. cash and cash equivalents | 10,962 | 6,269 | 75% | 3,647 | 1,268 | 1,073 |

| incl. goodwill | 45,576 | 43,085 | 6% | 42,628 | 37,969 | 37,969 |

| Current liabilities | 20,947 | 18,945 | 11% | 21,647 | 12,186 | 8,372 |

| Non-current liabilities | 19,619 | 20,613 | -5% | 22,137 | 14,118 | 15,091 |

| Total liabilities | 40,566 | 39,558 | 3% | 43,784 | 26,304 | 23,463 |

| incl. borrowings | 22,219 | 22,202 | 0% | 24,342 | 15,474 | 15,257 |

| Equity | 53,692 | 54,619 | -2% | 51,622 | 50,434 | 52,494 |

| Financial ratios (%) | 31.12.2021 | 31.12.2020 | 31.12.2019 | 31.12.2018 | 31.12.2017 | |

| Equity ratio (%) | 57% | 58% | 54% | 66% | 69% | |

| Debt to equity ratio (%) | 41% | 41% | 47% | 31% | 29% | |

| Debt to capital ratio (%) | 17% | 23% | 29% | 22% | 21% | |

| Total debt/EBITDA ratio | 2.70 | 3.17* | 3.59* | 3.63* | 2.44* | |

| Liquidity ratio | 0.98 | 0.98 | 0.90 | 1.13 | 1.65 | |

| * For years 2020-2017 total debt/EBITDA ratio is calculated on the basis of EBITDA, which also includes EBITDA from discontinued operations. | ||||||

Statement of the chairman of the management board

The year 2021 was successful for Ekspress Grupp. The prolonged Covid-19 pandemic and heightened attention to what was going on in the society increased the interest in classical journalism. The investments made in previous years in journalists and creation of high-quality content have brought us success. This primarily manifests itself in continued growth in the number of digital subscriptions.

By the end of the year, the various companies of Ekspress Grupp had almost 135 000 digital subscriptions. Estonia has the most subscriptions of digital content with Ekspress Meedia attaining the highest number of digital subscriptions. The number of digital subscriptions of Õhtuleht Kirjastus demonstrated very good growth in 2021. It is evident that readers in the market are keenly interested in periodicals with varied content which gives us courage to experiment with various formats in order to grow the number of digital subscriptions in coming years.

Overall, the year 2021 was successful for the Group: despite the ongoing pandemic and the economic uncertainty due to the coronavirus, the Group managed to reinforce its market position and significantly improve its profitability. As compared to 2020, the 12-month revenue increased by 20% to 53.5 million and the net profit increased by 61% to EUR 4.1 million. The share of the Group’s digital revenue was 76% of the total revenue at the end of December.

– Mari-Liis Rüütsalu, Chairman of the Management Board